2025 Crypto Trends: What Investors Need to Know

The world of cryptocurrency is constantly evolving, and as we enter the year 2025, there are several trends that investors need to be aware of. From the rise of decentralized finance (DeFi) to the increasing adoption of blockchain technology, the crypto landscape is changing rapidly. In this article, we will explore the top crypto trends of 2025 and what investors need to know to stay ahead of the curve.

1. Decentralized Finance (DeFi)

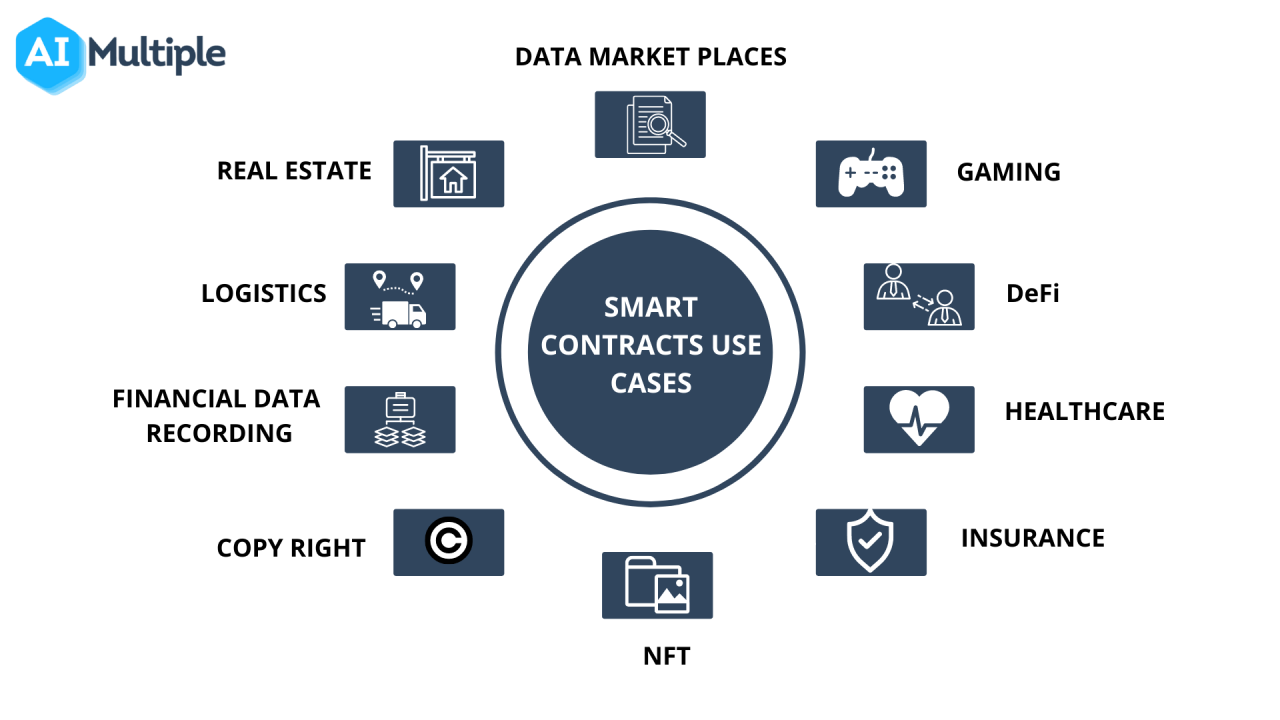

DeFi has been one of the hottest topics in the crypto space over the past few years, and its popularity is expected to continue in 2025. DeFi refers to the use of blockchain technology and smart contracts to create decentralized financial systems, such as lending platforms, stablecoins, and decentralized exchanges (DEXs). DeFi has the potential to disrupt traditional finance by providing greater transparency, security, and accessibility.

Investors interested in DeFi can explore various protocols and platforms, such as MakerDAO, Compound, and Uniswap. These platforms offer a range of financial services, from lending and borrowing to trading and yield farming. However, investors should be aware of the risks associated with DeFi, including market volatility, smart contract risks, and regulatory uncertainty.

2. Bitcoin Halving

The Bitcoin halving, which is expected to occur in 2024, will have a significant impact on the crypto market in 2025. The halving reduces the supply of new Bitcoins entering the market, which can lead to increased demand and higher prices. Historically, the Bitcoin halving has been a catalyst for significant price increases, and many investors are expecting a similar outcome in 2025.

However, investors should be aware that the halving is not the only factor that affects the price of Bitcoin. Other factors, such as global economic trends, regulatory developments, and technological advancements, can also influence the price of Bitcoin. Investors should conduct thorough research and consider multiple perspectives before making investment decisions.

3. Blockchain Adoption

Blockchain technology is becoming increasingly adopted across various industries, from finance to healthcare to supply chain management. In 2025, we can expect to see more companies and governments exploring the use of blockchain to improve efficiency, transparency, and security.

Investors can benefit from this trend by investing in companies that are leading the charge in blockchain adoption. This can include companies that provide blockchain-based solutions, such as IBM, Microsoft, and Accenture, as well as companies that are using blockchain to improve their own operations, such as Walmart and Maersk.

4. Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the development of digital currencies, known as CBDCs. CBDCs are digital versions of a country’s fiat currency, which can be used for transactions and settlements. In 2025, we can expect to see more central banks launching their own CBDCs, which could have significant implications for the crypto market.

Investors should be aware that CBDCs are different from traditional cryptocurrencies, such as Bitcoin and Ethereum. CBDCs are issued and regulated by central banks, which can provide greater stability and security. However, CBDCs can also be subject to government control and surveillance, which may raise concerns about privacy and decentralization.

5. Regulatory Clarity

Regulatory clarity is a top priority for the crypto industry in 2025. Governments around the world are grappling with how to regulate cryptocurrencies, and investors are eagerly awaiting clear guidelines. In 2025, we can expect to see more regulatory developments, including the introduction of new laws and regulations.

Investors should be aware of the regulatory landscape and how it may impact their investments. Regulatory clarity can provide greater certainty and stability for investors, but it can also lead to increased compliance costs and restrictions on certain activities.

6. Security Tokens

Security tokens are expected to become more prominent in 2025. Security tokens are digital representations of traditional securities, such as stocks and bonds, which are issued and traded on blockchain platforms. Security tokens offer greater efficiency, transparency, and accessibility than traditional securities, and they can provide investors with new opportunities for diversification and returns.

Investors interested in security tokens can explore various platforms, such as Polymath and Securitize, which offer a range of security tokens, from real estate investment trusts (REITs) to venture capital funds. However, investors should be aware of the regulatory risks associated with security tokens, including the need for compliance with securities laws and regulations.

7. Quantum Computing

Quantum computing is a rapidly advancing field that has significant implications for the crypto industry. Quantum computers have the potential to break certain types of encryption, which could compromise the security of blockchain networks and cryptocurrencies. In 2025, we can expect to see more research and development in quantum computing, as well as efforts to mitigate the risks associated with quantum attacks.

Investors should be aware of the potential risks and benefits of quantum computing and how it may impact their investments. Quantum computing can provide significant benefits, such as improved efficiency and security, but it also raises concerns about the potential for quantum attacks and the need for quantum-resistant cryptography.

8. Sustainable Cryptocurrency

Sustainable cryptocurrency is a growing trend in 2025. As concerns about climate change and environmental sustainability grow, investors are seeking out cryptocurrencies that are more energy-efficient and environmentally friendly. Sustainable cryptocurrencies, such as Chia and Cardano, use proof-of-stake (PoS) consensus algorithms, which require less energy than traditional proof-of-work (PoW) algorithms.

Investors interested in sustainable cryptocurrency can explore various options, including Chia, Cardano, and Tezos. These cryptocurrencies offer a range of benefits, including energy efficiency, security, and decentralization. However, investors should be aware of the potential risks associated with sustainable cryptocurrency, including market volatility and regulatory uncertainty.

9. Gaming and Virtual Reality

Gaming and virtual reality (VR) are becoming increasingly important in the crypto space. In 2025, we can expect to see more blockchain-based gaming platforms and VR experiences, which can provide new opportunities for entertainment, socialization, and monetization.

Investors interested in gaming and VR can explore various platforms, such as Decentraland and The Sandbox, which offer a range of experiences, from games and simulations to social media and virtual events. However, investors should be aware of the potential risks associated with gaming and VR, including market volatility, regulatory uncertainty, and the need for high-quality content and user engagement.

10. Institutional Investment

Institutional investment is a significant trend in the crypto space in 2025. As more institutional investors, such as pension funds and endowments, enter the market, we can expect to see increased demand for cryptocurrencies and blockchain-based assets. Institutional investors can provide significant benefits, including increased liquidity, stability, and credibility.

Investors interested in institutional investment can explore various options, including investment funds, such as Grayscale and Bitwise, which offer a range of cryptocurrency and blockchain-based investment products. However, investors should be aware of the potential risks associated with institutional investment, including regulatory uncertainty, market volatility, and the need for high-quality due diligence and risk management.

In conclusion, the crypto landscape is changing rapidly, and investors need to stay ahead of the curve to capitalize on the opportunities and mitigate the risks. The top crypto trends of 2025, including DeFi, Bitcoin halving, blockchain adoption, CBDCs, regulatory clarity, security tokens, quantum computing, sustainable cryptocurrency, gaming and VR, and institutional investment, offer a range of opportunities for investors to diversify their portfolios and generate returns. However, investors should always conduct thorough research, consider multiple perspectives, and consult with experts before making investment decisions.